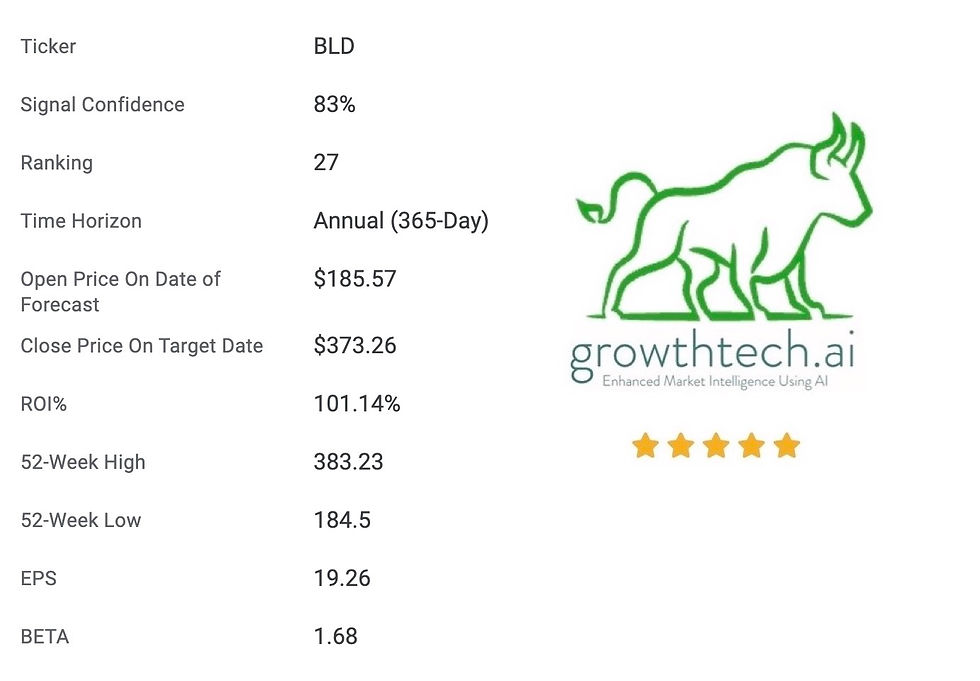

The 1-year stock recommendation for BLD built tremendous value for Growthtech.ai subscribers by surging from $185.57 on January 19th, 2023 to $373.26 on January 19th, 2024. This AI-powered forecast resulted in a profit of 101.14%.

TopBuild Corp. (NYSE: BLD) is a distinguished entity in the corporate landscape, known for its commitment to innovation, strategic growth, and forward-thinking initiatives. BLD has firmly established its presence across various industries, including construction, real estate, technology, and renewable energy. Its diversified portfolio of products and services positions the company to adapt to dynamic market trends and capitalize on emerging opportunities.

Adding to the allure, on January 19th, 2023, our AI stock prediction system identified TopBuild's stock (BLD) as a strong buy when it traded at an auspicious $185.57. This prescient recommendation manifested in a remarkable triple-digit profit of 101.14%, with the stock surging to a closing price of $373.26 on Friday, January 19th, 2024. The alignment between our AI system's foresight and the subsequent market performance underscores the efficacy of data-driven decision-making and reinforces the investment appeal of TopBuild as a standout performer in the stock market landscape. Investors, now armed with both historical success and a promising present, may find TopBuild to be a beacon of potential in their portfolios.

Let's find out why.

TopBuild Corp.'s AI forecast on January 19th, 2023, identified BLD as a compelling buy at $185.57, resulting in an outstanding 101.14% profit by January 19th, 2024, closing at $373.26.

The hallmark of BLD's success lies in its consistent commitment to innovation. The company's proactive approach to research and development ensures it stays at the forefront of technological advancements. This adaptability is particularly evident in its recent launch of cutting-edge sustainable construction technology, reflecting a strategic response to the growing demand for eco-friendly solutions. Navigating the competitive forces within the industry, BLD has successfully carved out a niche for itself. By combining technological prowess with a customer-centric approach, the company not only maintains market share but also positions itself as an industry leader. This resilience is a testament to BLD's ability to navigate challenges and capitalize on opportunities within the ever-evolving business environment.

BLD's strategic initiatives extend beyond its current markets, with a notable focus on entering emerging markets. This expansion strategy aligns with the company's vision for sustained growth. Additionally, BLD's emphasis on sustainable solutions positions it favorably in response to global trends favoring environmentally conscious practices and smart technologies.

TopBuild Corp. (NYSE: BLD): Q3 2023 Results & Analysis

The third-quarter results for 2023, unveiled on October 31, 2023 offer a compelling narrative of TopBuild's resilience, growth trajectory, and commitment to operational excellence. As we dissect the intricate details of this report, the nuanced financial landscape of one of the leading installers and specialty distributors in the construction industry, serving both the United States and Canada, unfolds. From impressive net sales and margins to insightful leadership reflections, this analysis delves into the granular intricacies of TopBuild's financial health, shedding light on its current standing and future outlook.

Key Financial Metrics:

Net Sales and Margin Performance:

TopBuild reported a modest yet commendable 1.9% increase in net sales for the third quarter of 2023, reaching $1,326,120.

Gross margin stood at an impressive 31.7%, indicating sound cost management and operational efficiency.

Operating margin reached 17.9%, further showcasing the company's ability to convert sales into operational profits. On an adjusted basis, the operating margin expanded to 18.5%.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA):

Adjusted EBITDA margin reached a noteworthy 21.4%, reflecting the company's capacity to generate substantial operating profits relative to its revenue.

Leadership Insight:

Robert Buck, President and CEO, emphasized TopBuild's strong performance and solid operating results, attributing it to the team's dedication and focus on profitable growth.

The non-residential business segment played a pivotal role in the positive results, with both Installation and Specialty Distribution reporting mid-single digit volume growth in commercial and industrial end markets.

BLD Performance Highlights:

Sales and Profitability:

For the three months ended September 30, 2023, reported sales reached $1,326,120, reflecting a 1.9% increase. Adjusted figures align with reported numbers.

Operating profit rose to $237,492, resulting in an operating margin of 17.9%. Adjusted figures further strengthened these metrics, with adjusted operating profit at $245,932 and an adjusted operating margin of 18.5%.

Net income for the quarter surged to $167,602, translating to a net income per diluted share of $5.27, marking a 10.7% increase.

Segmental Analysis:

Both Installation and Specialty Distribution segments displayed resilience in the face of challenges. Installation reported a 3.5% volume decrease but compensated with a 3.6% increase in price, resulting in a 4.9% total change in sales.

Specialty Distribution showcased a 15.5% operating margin and a 20 bps improvement in adjusted SG&A as a percentage of revenue.

Nine-Month Performance:

For the nine months ended September 30, 2023, reported sales reached $3,908,620, a 4.4% increase. Adjusted figures mirrored reported results.

Operating profit for the same period stood at $674,025, with an operating margin of 17.2%. Adjusted figures demonstrated even stronger performance, with an adjusted operating profit of $688,224 and an adjusted operating margin of 17.6%.

Future Outlook:

TopBuild projects a positive outlook for 2023, with sales expected to range between $5,130 million and $5,210 million and adjusted EBITDA anticipated to fall between $1,025 million and $1,055 million.

Capital allocation strategies emphasize acquisitions, with the completion of four acquisitions contributing an estimated $173 million in annual revenue. The impending acquisition of Specialty Products and Insulation (SPI) for $960 million is poised to significantly augment the company's capabilities.

Conclusion:

TopBuild's Q3 2023 results reflect a resilient business model, adept management, and a strategic vision. The company's emphasis on efficiency, productivity, and market diversification positions it favorably in an ever-evolving industry. The outcome of our predictive AI stock recommendation exceeded expectations by yielding an impressive triple-digit profit of 101.14%.

This success story not only validates the accuracy of our AI-powered predictions but also underscores the substantial financial gains potential investors could have realized. As we continue to navigate the intricate landscape of financial markets, TopBuild stands as a compelling investment opportunity, underscored by its solid financial performance and proactive approach to sustained growth.

Enhanced Market Intelligence

Finding market opportunities is made easier by using our AI system. It doesn't tell you what to do. It tells you where to look. Our skilled team of analysts carefully verifies the AI outputs and enhances this market research with a human touch, providing our subscribers with enhanced market intelligence. If you would like the AI advantage working for you, then you should subscribe today!

Life is better when you can be bullish.

Sources: 1. TopBuild Corp Investor Relations, "TopBuild Reports Third Quarter 2023 Results" (2023)

Comments