Abercrombie & Fitch Co. (NYSE: ANF) was identified as a compelling buy at $29.43 on February 2nd, 2023. This AI-powered forecast resulted in an exceptional 271.97% profit by February 2nd, 2024, with the stock closing at $109.47.

Abercrombie & Fitch Co. (NYSE: ANF) stands as a prominent name in the retail industry, recognized for its distinctive brand identity and evolving market strategies. Established in 1892, Abercrombie & Fitch Co. has traversed a long trajectory in the retail sector, undergoing various transformations to adapt to changing consumer preferences and market dynamics. Initially renowned for its upscale casual wear targeting young adults, the company has expanded its brand portfolio to include Abercrombie Kids and Hollister Co., catering to a diverse demographic of customers.

On February 2nd, 2023 ANF was listed as a top stock selection as the number 1 stock recommendation in the 1-year time horizon concluding this past Friday, February 2nd, 2024.

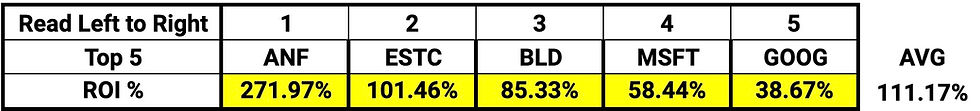

The AI stock forecasting technology analyzes empirical data on financial market irregularities linked to trader overreaction and underreaction to produce daily forecasts in various time frames. Below is the full Top 5 forecast available in the Basic Subscription for the 1-year time horizon posted on February 2nd, 2023.

This stock forecast resulted in a 100% hit ratio with an exceptional average return of 111.17% if all stocks were purchased in equal weights on February 29th and held for 365 days or 1 year.

We judge the predictive AI's performance against the S&P 500, which over the same period resulted in a return of 20.11%. In this instance, the Top 5 stock picks beat the S&P 500 by a massive margin of 97.06%!

One of the main advantages of using growthtech.ai’s predictive AI software for stock analysis is its ability to objectively study a large number of assets and give you the best market options ranked in multiple time horizons from the short to the long term.

Click here, if you want to learn more about how this technology works

ANF Always Forward Plan Overview:

Abercrombie & Fitch Co. (NYSE: ANF) unveiled its Always Forward Plan during its Investor Day, showcasing the company's strategic vision and financial targets for the coming years. The plan is designed to leverage the company's omnichannel capabilities and digital penetration to accelerate global growth across its brands and deliver shareholder value.

2025 Financial Targets:

The company aims to achieve annual revenues of $4.1 billion to $4.3 billion and a sustainable annual operating margin rate at or above 8% by the end of fiscal 2025. This outlook reflects the company's confidence in its ability to navigate through dynamic global, economic, and political environments while making progress against long-term strategic goals.

Long-Term Financial Targets:

Looking further ahead, Abercrombie & Fitch Co. envisions reaching annual revenues of $5 billion and a sustainable annual operating margin rate at or above 10%, signifying its commitment to long-term growth and profitability.

Strategic Growth Principles:

The Always Forward Plan is underpinned by three strategic growth principles, aligned with the company's Corporate Purpose:

Execute Focused Brand Growth Plans:

The company has identified growth opportunities across its brand portfolio, including Abercrombie & Fitch, Abercrombie Kids, Hollister, and Gilly Hicks. Each brand has specific sales Compound Annual Growth Rate (CAGR) targets aimed at driving overall revenue growth.

Accelerate an Enterprise-Wide Digital Revolution:

Abercrombie & Fitch Co. plans to intensify its digital initiatives by enhancing customer analytics and improving customer experience across all digital touchpoints. The goal is to better understand customer needs and preferences while ensuring seamless omnichannel integration.

Operate with Financial Discipline:

The company emphasizes financial discipline in its investment approach, aiming to self-fund a disciplined and agile investment plan. This plan focuses on driving omnichannel growth across digital platforms and stores while generating significant free cash flow to provide consistent shareholder returns.

CEO's Perspective:

Fran Horowitz, CEO of Abercrombie & Fitch Co., expressed confidence in the company's ability to execute the Always Forward Plan amidst evolving market dynamics. She highlighted the company's transformation over the past few years, emphasizing its clear brand positioning, enhanced digital capabilities, and commitment to customer-centric strategies.

Analyzing Q3 Performance and Future Outlook

Abercrombie & Fitch Co. (NYSE: ANF) has reported robust third-quarter results, showcasing significant growth across various financial metrics. The company achieved a notable net sales growth of 20%, driven by a remarkable comparable sales growth of 16%. Both its Abercrombie and Hollister brands contributed to the positive momentum, with Abercrombie brands experiencing a remarkable 30% net sales growth and Hollister brands achieving an 11% net sales growth during the quarter.

One of the most impressive highlights of the quarter is the notable expansion in operating margin, reaching 13.1%, which marks a substantial 1,110 basis point improvement from the same period in the previous year. This expansion was primarily fueled by gross profit rate expansion and operating expense leverage, indicating operational efficiency and effective cost management strategies employed by the company.

Fran Horowitz, the CEO of Abercrombie & Fitch Co., attributed the strong performance to the company's global playbook, which has been effective across its brand portfolio. The company's strategic focus on product acceptance, controlled inventories, and investments in technology and marketing has resulted in exceptional gross profit rate expansion and operational margin improvement.

Looking ahead, the company is optimistic about its performance for the remainder of the fiscal year, particularly during the crucial holiday season. As a result, Abercrombie & Fitch Co. has increased its full-year outlook for both net sales growth and operating margin, reflecting confidence in its ability to sustain profitable growth and meet customer demand.

Financially, Abercrombie & Fitch Co. maintains a strong liquidity position, with cash and equivalents totaling $649 million as of October 28, 2023, and liquidity of approximately $1.0 billion when considering cash, equivalents, and available borrowing under its credit facility. Additionally, the company's inventory decreased by 20% compared to the same period last year, indicating effective inventory management practices.

In terms of capital allocation, the company remains focused on prudent financial management and strategic investments. It reported net cash provided by operating activities of $350 million for the year-to-date period ended October 28, 2023, along with net cash used for investing activities of $128 million and net cash used for financing activities of $87 million.

Looking forward to the full fiscal year 2023, Abercrombie & Fitch Co. has revised its outlook, expecting net sales growth of 12% to 14% and an operating margin of around 10%. These adjustments reflect the company's confidence in its ability to sustain growth momentum and deliver shareholder value amidst evolving market dynamics.

In conclusion, Abercrombie & Fitch Co.'s third-quarter results demonstrate a strong performance driven by robust sales growth, improved operating margins, and strategic initiatives. The company's ability to adapt to changing consumer preferences, drive operational efficiencies, and capitalize on growth opportunities positions it well for continued success in the retail industry. The next earnings call for Abercrombie & Fitch 4th quarter 2023 will be on Mar 06, 2024, at 8:30 AM EST.

Enhanced Market Intelligence

Finding market opportunities is made easier by using our AI system. It doesn't tell you what to do. It tells you where to look. Our skilled team of analysts carefully verifies the AI outputs and enhances this market research with a human touch, providing our subscribers with enhanced market intelligence. If you would like the AI advantage working for you, then you should subscribe today!

Life is better when you can be bullish.

Sources: 1. Abercrombie & Fitch Investor Relations, "ABERCROMBIE & FITCH CO. REPORTS THIRD QUARTER RESULTS" (2023)

2. Abercrombie & Fitch Investor Relations, "ABERCROMBIE & FITCH CO. ANNOUNCES ALWAYS FORWARD PLAN" (2022)

Comments