From $71.23 to $120.90, PKX was only the 3rd best-performing selection from the Top 5 where the average return was 100.97% beating the S&P 500 by a factor of 10X.

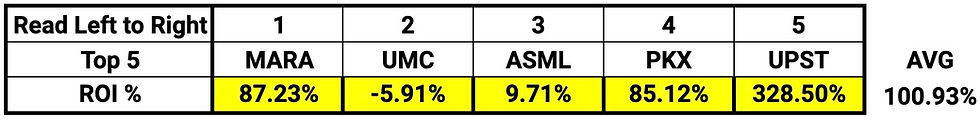

This leading multinational steel-making company is based in South Korea. Established in 1968, Posco Holdings Inc. (NYSE: PKX) also known as POSCO has garnered a stellar reputation as one of the world's largest and most innovative steel producers. Headquartered in Pohang, South Korea, the company operates across a wide spectrum of industries, including automotive, shipbuilding, construction, and energy. With a global presence, POSCO has strategically positioned itself to capitalize on emerging markets and cater to diverse customer demands. The company maintains a robust supply chain and has established long-term partnerships with various enterprises worldwide, securing its position as a preferred supplier for critical steel components. Leveraging the power of advanced AI algorithms, our innovative stock prediction system identifies stocks with specific traits that align with the interests of value investors. Notably, our system recognized the potential of PKX in the 90-day time frame and promptly recommended it to our subscribers. The result was nothing short of remarkable, with a fantastic 85.12% return on investment (ROI) within a mere 3 months, demonstrating the immense value of AI in generating profitable investment decisions. PKX's Q2 2023 press release published on July 25th, 2023 showcases the company's ability to thrive in the eco-friendly materials market. The strategic focus on green infrastructure, sustainable steel production, and expansion into hydrogen projects and battery materials have paid off, resulting in impressive financial growth. While uncertainties persist in global business environments, PKX's performance demonstrates its commitment to sustainable growth and its ability to adapt to market conditions. Investors and stakeholders should consider PKX as a promising long-term investment in the eco-friendly future materials sector. However, it is crucial to be mindful of potential risks and uncertainties, given the forward-looking nature of certain statements in the press release. Just before the first quarter results were announced, on April 25th, 2023, our AI-powered market intelligence system using machine learning algorithms recognized PKX as a top stock pick in the 90-day time horizon closing July 24th, 2023 thus yielding an 85.12% profit during the 2Q23. The AI stock prediction system analyzes empirical data on financial market irregularities linked to trader overreaction and underreaction to produce circadian forecasts in various frames. Below is the Top 5 forecast for the 1-month time horizon on April 25th resulting in a hit ratio of 80% and an average return of 100.93% if all stocks were purchased in equal weights on April 25th and held for 90 days or 3 months.

Compare this to the S&P 500 over the same time frame which resulted in a return of only 10.69% over the same time frame meaning that the Top 5 beat it by 10X.

POSCO Company Overview

Despite its formidable stature in the steel industry, POSCO faces several challenges that demand constant attention and strategic adaptation. One of the primary concerns is the cyclicality of the steel market. Fluctuations in global demand and oversupply in certain regions can significantly impact POSCO's revenue and profitability. The company must navigate through these volatile market conditions with agility and foresight to sustain growth. Moreover, environmental and sustainability issues pose a substantial hurdle for POSCO. As a major player in the steel sector, the company faces increased scrutiny from regulatory bodies and environmental activists. The demand for eco-friendly and sustainable practices in steel production presents both an opportunity and a challenge for POSCO. The need to invest in greener technologies while remaining cost-competitive requires a delicate balance to maintain profitability.

Additionally, the steel industry's intensifying competition, especially from emerging economies with lower production costs, compels POSCO to constantly improve efficiency and optimize its operational processes. Maintaining a high level of technological prowess is essential for the company to remain ahead of its rivals.

Despite the challenges it encounters, POSCO boasts a remarkable track record of historical successes that have fortified its position in the global steel market. One of the company's notable achievements is its commitment to research and development (R&D). POSCO has invested significantly in innovative technologies and process improvements, enabling it to produce high-quality steel products with enhanced mechanical properties and reduced environmental impact. Furthermore, POSCO's relentless pursuit of vertical integration has been a driving force behind its historical successes. By investing in upstream operations like iron ore mining and downstream ventures like the construction of energy-efficient buildings, the company has created a resilient and interconnected supply chain. This integration not only reduces production costs but also mitigates risks associated with supply chain disruptions.

Another key success factor for POSCO lies in its international expansion and diversified product portfolio. The company has strategically established subsidiaries and joint ventures in various countries, allowing it to access new markets and leverage regional demand dynamics. Additionally, POSCO's product diversification beyond traditional steel products, such as electrical steel and automotive sheets, has provided a buffer against market volatility and opened new revenue streams. Moreover, POSCO's proactive approach to corporate social responsibility (CSR) has positively impacted its brand image and stakeholder relations. Through various sustainability initiatives, the company has demonstrated its commitment to environmental preservation and community development, earning accolades from stakeholders and investors alike.

PKX Stock Forecast Review

PKX stock represents the thriving conglomerate, POSCO, which has emerged as a prominent player in the global steel market. Despite facing challenges related to market cyclicality, environmental concerns, and intensifying competition, POSCO has displayed resilience through its historical successes. These achievements, driven by strategic R&D investments, vertical integration, international expansion, diversified product offerings, and responsible corporate practices, position POSCO as a financially sound and adaptable entity in the highly competitive steel industry. Investors keen on exposure to the steel sector should closely monitor PKX stock's performance, keeping a watchful eye on POSCO's efforts to innovate and address emerging challenges in the market.

In fact, PKX was recently recommended by our intuitive AI-powered market intelligence system which is referred to officially as a Decision Support System (DSS). It is intended to help you increase precision, quicker decision-making, unbiased analysis, risk management, enhanced efficiency, and adaptability. While staying true to this approach, we also keep a close eye on the latest value, growth, and momentum trends to highlight the most robust investment opportunities.

The benefits a DSS can provide include:

Increased accuracy: AI algorithms can process vast amounts of data quickly and accurately, which can lead to more accurate predictions and better decision-making.

Faster decision-making: Since AI algorithms can process large amounts of data much faster than humans, they can help investors make informed decisions much more efficiently.

Objective analysis: AI algorithms can analyze data objectively and without biases, which can lead to more objective investment decisions.

Risk management: AI can help identify potential risks in investments and portfolios, allowing investors to manage risks more effectively.

Improved efficiency: AI can automate many tasks involved in stock market analysis, such as data collection and analysis, freeing up time for investors to focus on other tasks.

Adaptability: AI algorithms can adapt to changing market conditions and adjust their predictions accordingly, which can lead to more accurate and relevant insights.

The ability of artificial intelligence (AI) to provide real-time analytics has completely changed the investment industry in the current digital era. Investors can examine enormous volumes of data, spot patterns, and trends, and make knowledgeable decisions by using AI-powered tools. The signal for PKX, a stock choice for the 90-day forecast on April 25th, 2023, is shown below.

The opening price on the date of the forecast was $71.23 and closed at $120.90 making a rounded 85.12% profit for subscribers.

The stock prediction system provides the Signal Confidence (SC) to help you assess the propensity of each prediction to succeed in addition to AI-based stock recommendations. The SC for this stock prediction is 65%. Though they raise risk, shorter-term predictions can be useful for spotting patterns. The accuracy of previous financial forecasts and current market factors affecting stock prices are taken into account by the AI system while calculating the SC. In general, longer-term forecasts have a higher SC and tend to be more accurate. One of the main advantages of using stock predictive software is its ability to objectively study many assets throughout the day. By integrating big data analytics with our AI prediction system, we can enhance decision-making, forecasting, result modeling, and market understanding. However, these signals should not be used as your sole discretionary decision-making factor, but instead, act as an effective tool to drastically reduce the time it takes to find new market opportunities.

Please note that this article is not intended as financial advice. Investors are advised to conduct their own research and consult with a financial professional before making any investment decisions. So for example, here the AI is recommending PKX, and now you would do your own due diligence to come to your own conclusions based on your own personal considerations.

Analyzing PKX Stock Q2 2023 Financial Results

In the quarterly press release for the second quarter of 2023, PKX (Global Eco-friendly Future Materials Provider) reported robust business performance amidst challenging market conditions. This article presents a detailed summary of the key financial metrics, major business activities, and strategic outlook derived from the unaudited financial statements. The focus will be on analyzing PKX's revenue, operating profit, business performance by major areas, and future prospects in the eco-friendly materials market.

Business Performance by Major Areas

Consolidated Revenue: In Q2 2023, PKX achieved a consolidated revenue of KRW 20,121 billion, reflecting a remarkable 3.0% quarter-on-quarter (QoQ) growth. This revenue surge can be attributed to several factors, including a market recovery and increased sales volumes in strategic business areas.

Major Business Activities: PKX demonstrated strong performance across its major business activities, with each segment contributing to the overall growth.

Steel Sector: The steel sector registered revenue of KRW 16,547 billion, a QoQ increase of KRW 777 billion. Notably, POSCO's domestic and overseas steel sales surged, driven by the normalization of operations at Pohang Steel Works. Moreover, the steel segment's operating profit saw a significant boost of KRW 683 billion, reaching KRW 1,021 billion in Q2 2023.

Green Infrastructure: The Green Infrastructure segment performed impressively, generating a revenue of KRW 15,195 billion, an increase of KRW 1,325 billion QoQ. This growth can be attributed to an uptick in sales of eco-friendly steel products, including renewable energy steel and Greenate-certified steel. The operating profit in this segment also rose to KRW 445 billion, an impressive QoQ increase of KRW 63 billion.

POSCO International: POSCO International experienced substantial growth, reporting a revenue of KRW 8,865 billion, and a QoQ increase of KRW 559 billion. This surge was mainly driven by the increased sales of high-profit steel products for wind and solar power in the Global Business division. The operating profit in this segment reached KRW 357 billion, with a QoQ increase of KRW 77 billion.

POSCO E&C: POSCO E&C, the construction arm of PKX, also demonstrated resilience in its business performance. With a revenue of KRW 2,591 billion, it achieved a QoQ increase of KRW 227 billion. Notably, its operating profit reached KRW 56 billion, showing a minor QoQ increase of KRW 1 billion.

Despite the persisting uncertainties in global business environments, PKX's outstanding performance highlights its steadfast commitment to sustainable growth and adaptability to market conditions. As investors and stakeholders assess their long-term investment options in the eco-friendly future materials sector, PKX emerges as a compelling choice. Nevertheless, it is crucial to exercise prudence and consider potential risks and uncertainties, as certain statements in the press release are forward-looking and subject to changes based on evolving business landscapes.

The Q2 2023 earnings release of PKX underscores the company's remarkable success in the thriving eco-friendly materials market. By strategically focusing on green infrastructure, sustainable steel production, and venturing into hydrogen projects and battery materials, PKX has achieved impressive financial growth.

Enhanced Market Intelligence

Finding market opportunities is made easier by using our AI system. It doesn't tell you what to do. It tells you where to look. Our skilled team of analysts carefully verifies the AI outputs and enhances this market research with a human touch, providing our subscribers with enhanced market intelligence. If you would like the AI advantage working for you, then you should subscribe today!

Life is better when you can be bullish.

Sources: 1. Posco Holdings Investor Relations, "Earnings Release Q2 2023 Global Eco-friendly Future Materials Provider July 24, 2023" (2023)

Comments