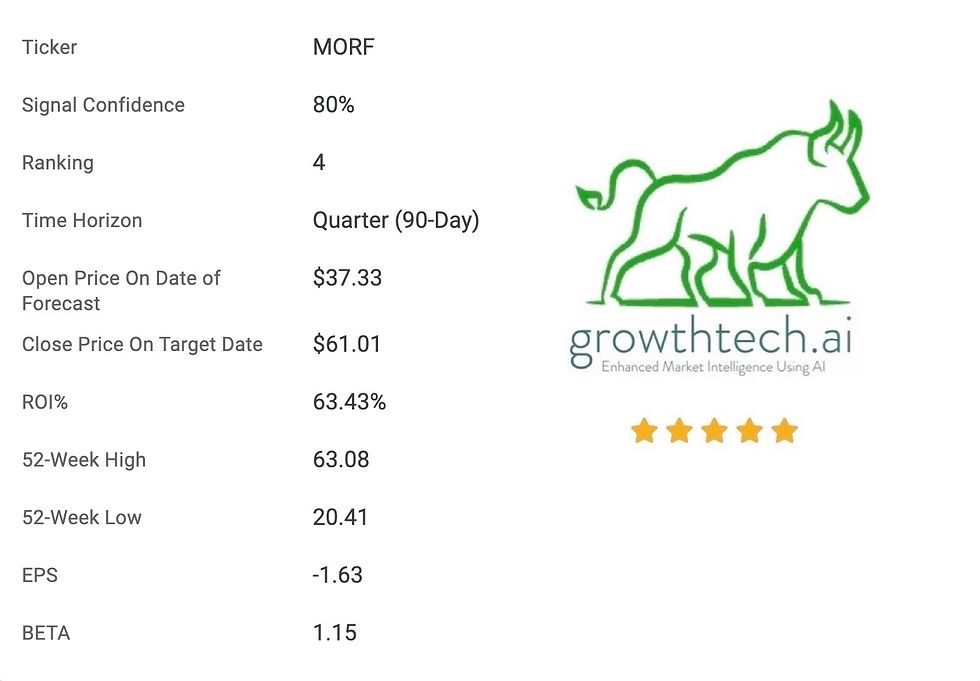

Top 5 AI stock pick powered by the implementation of a meticulous big data strategy resulted in an impressive 63.43% profit surge.

In the realm of financial markets, investors are constantly seeking opportunities that offer substantial returns and growth potential. One such company that has garnered significant attention in recent times is Morphic Therapeutic (NASDAQ: MORF). Our innovative stock prediction system employs advanced AI algorithms to identify stocks with specific traits that are of interest to value investors. Our system is designed to recognize long-term bullish positions, helping investors make the right investment decisions at the right time. By analyzing massive volumes of data, finding patterns, and spotting trends continuously, AI-powered technologies recently recognized Morphic Therapeutic's potential in the 90-day time frame and suggested it to our subscribers on March 24th, 2023. In only 3 months, this MORF recommendation resulted in a fantastic 63.43% return on investment (ROI), underlining the value of AI in generating profitable investment choices. MORF operates in the rapidly evolving field of biotechnology, specializing in the development and commercialization of innovative therapies for genetic disorders. Leveraging cutting-edge gene editing technologies, MORF aims to address unmet medical needs by targeting genetic mutations responsible for various diseases. The company's proprietary platform holds immense potential, as it provides a unique approach to treating hereditary ailments.

With its innovative gene editing platform, impressive revenue growth, and robust gross margins, the company is well-positioned to capitalize on the growing demand for genetic therapies. However, investors must carefully consider the inherent risks associated with the industry, including regulatory hurdles and the competitive landscape. Diligent monitoring of MORF's clinical trial progress and regulatory developments is essential to make informed investment decisions.

Within the fiercely competitive biotechnology industry, MORF encounters formidable competition from established pharmaceutical giants and emerging biotech companies. Notably, prominent players such as Pfizer, Johnson & Johnson, and Novartis are among the major contenders in this space. These industry stalwarts possess vast financial resources, robust research and development capabilities, and expansive distribution networks, granting them a significant advantage in swiftly bringing new therapies to market and capturing substantial market share.

Furthermore, the biotech industry operates within a complex regulatory landscape, necessitating compliance with rigorous standards set by regulatory authorities such as the U.S. Food and Drug Administration (FDA). MORF's success heavily relies on securing regulatory approvals for its therapies, which can be a time-consuming and costly process. Delays or rejections in obtaining necessary approvals can significantly impact the company's financial performance and hinder its growth trajectory.

Additionally, inherent risks associated with clinical trials and drug development cannot be overlooked. MORF must navigate the challenging journey of conducting successful trials, managing potential adverse events, and demonstrating the safety and efficacy of its therapies. Any setbacks in clinical trials can have severe consequences for investor sentiment and the company's market value.

That being said, Morphic Therapeutic's first-quarter 2023 paints a promising picture for the company's future. The positive results from the EMERALD-1 trial of MORF-057 in patients with ulcerative colitis, along with the ongoing progress in the EMERALD-2 trial, demonstrate the potential clinical benefits of MORF's oral integrin therapies. The successful definition of myelofibrosis as a new therapeutic area and the initiation of a small molecule integrin inhibitor program for pulmonary hypertensive diseases further solidify MORF's commitment to therapeutic innovation.

Moreover, MORF Corp's robust financial position, bolstered by $421 million in cash and marketable securities, instills confidence in the company's ability to fund its operations and advance its clinical pipeline. The extended cash runway provides significant financial stability, allowing for the later-stage clinical development of MORF-057 and the exploration of emerging integrin therapies.

MORF Stock Forecast Review

The realm of finance has been profoundly disrupted due to the advent of artificial intelligence (AI). The transformative capabilities of AI in delivering real-time analytics have completely revolutionized the investment industry in today's digital age. Investors now have the remarkable ability to analyze vast quantities of data, detect intricate patterns and trends, and make informed decisions through the utilization of AI-powered tools. Consequently, the signal for MORF, a stock under scrutiny for the 3-month (90-day) forecast as of March 24th, 2023, is presented below, offering valuable insights for potential investors.

The opening price on the date of the forecast was $37.33 and closed at $61.01 making a rounded 63.43% profit for subscribers.

The stock prediction system employs an advanced Signal Confidence (SC) metric, along with AI-based stock recommendations, to provide users with a comprehensive assessment of the likelihood of success for each prediction. In the case of this particular stock prediction, the SC stands at an impressive 80%. While shorter-term predictions may introduce increased risk, they can prove valuable in identifying underlying patterns. The AI system takes into account the accuracy of previous financial forecasts as well as current market factors influencing stock prices when calculating the SC. Typically, longer-term forecasts exhibit higher SC values and demonstrate greater accuracy.

One of the key advantages of utilizing stock predictive software lies in its objective analysis of multiple assets throughout the day. By integrating big data analytics with our AI prediction system, we can augment decision-making processes, enhance forecasting accuracy, model potential outcomes, and gain deeper insights into the market. It is important to note, however, that these signals should not serve as the sole basis for discretionary decision-making. Rather, they should be employed as a powerful tool to significantly reduce the time required to identify new market opportunities.

It is essential to recognize that the information provided does not constitute financial advice. Investors are strongly advised to conduct their own thorough research and seek guidance from a qualified financial professional before making any investment decisions. Crucially, investors must perform their due diligence and arrive at their own conclusions based on personal considerations and risk tolerance.

MORF Stock: Analyzing Q1 2023 Financial Results

On April 25th, 2023 Morphic Therapeutic (Nasdaq: MORF) released its highly anticipated first-quarter 2023 corporate highlights and financial results. The comprehensive report encompasses key milestones achieved during the period, including significant advancements in clinical trials, emerging pipeline developments, and a strong financial position.

Clinical Trial Success and Progress:

One of the notable highlights from the first quarter of 2023 was the positive topline results from the main cohort of the EMERALD-1 open-label, single-arm Phase 2a trial of MORF-057 in patients with moderate to severe ulcerative colitis (UC). MORF-057, administered at a dose of 100 mg BID (twice daily), demonstrated clinically meaningful improvements across various measures, meeting the trial's primary endpoint with statistical significance. Notably, the Robarts Histopathology Index (RHI) Score exhibited a reduction of 6.4 points (p=0.002) from baseline at week 12, while achieving a remission rate of 25.7% based on the Modified Mayo Clinic Score (mMCS). The therapy was also well-tolerated, with no safety concerns reported.

In addition to the positive results from EMERALD-1, MORF Corp continued to make progress in its EMERALD-2 Phase 2b trial of MORF-057 in patients with moderate to severe UC. This global randomized, double-blind, placebo-controlled study aims to assess the clinical remission rate as measured by mMCS at 12 weeks. The results of EMERALD-2 are expected to be reported in the first half of 2025.

Preclinical Data and Emerging Pipeline:

MORF Corp presented new preclinical data on MORF-057 at the European Crohn's and Colitis Organization Annual Meeting 2023. These data highlighted the effectiveness of α4β7 inhibition in animal models of inflammatory bowel disease (IBD), providing further support for the ongoing EMERALD Phase 2 clinical trials of MORF-057 in IBD.

Furthermore, MORF Corp defined myelofibrosis as a new therapeutic area, signaling its commitment to developing selective αvβ8 small molecule inhibitors for the suppression of TGFB activation associated with myelofibrotic disease. Additionally, the company announced the initiation of a new small molecule integrin inhibitor program targeting an undisclosed integrin receptor for the treatment of pulmonary hypertensive diseases. These developments underscore MORF's commitment to advancing innovative integrin therapies across a diverse range of indications.

Financial Performance and Stability:

In terms of financial performance, MORF Corp reported a net loss of $36.1 million, or $0.90 per share, for the first quarter of 2023. This compares to a net loss of $31.5 million, or $0.85 per share, for the same period last year. The increase in net loss can be attributed to higher research and development expenses, primarily driven by increased clinical and development costs associated with MORF-057's preclinical and Phase 2 clinical trials.

Despite the increase in net loss, MORF Corp showcased a strong financial position, concluding the first quarter of 2023 with $421 million in cash, cash equivalents, and marketable securities. This substantial cash balance extended the company's financial runway well into the second half of 2026. The increased cash position was primarily due to a private placement of Morphic's common stock and pre-funded warrants completed in February 2023.

In conclusion, MORF Corp's achievements in the first quarter of 2023 position the company favorably for future growth and success in the competitive biopharmaceutical landscape. The positive clinical outcomes, advancements in pipeline development, and financial stability make MORF stock an enticing opportunity for investors seeking exposure to the potential of oral integrin therapies in the treatment of severe chronic diseases. However, investors must carefully consider the inherent risks associated with the industry, including regulatory hurdles and the competitive landscape. Diligent monitoring of MORF's clinical trial progress and regulatory developments is essential to make informed investment decisions. As always, investors should conduct thorough due diligence and consult with a qualified financial advisor before making any investment choices.

Enhanced Market Intelligence

Finding market opportunities is made easier by using our AI system. It doesn't tell you what to do. It tells you where to look. Our skilled team of analysts carefully verifies the AI outputs and enhances this market research with a human touch, providing our subscribers with enhanced market intelligence. If you would like the AI advantage working for you, then you should subscribe today!

Life is better when you can be bullish.

Sources: 1. Morphic Therapeutic Investor Relations, "Morphic Announces Corporate Highlights and Financial Results for the First Quarter 2023" (2023)

Comentarios