Carvana (NYSE: CVNA) has rebounded strongly in 2024, leveraging its digital-first model, operational efficiencies, and strategic acquisitions to drive record earnings, stock growth, and renewed investor confidence.

Carvana Co. (NYSE: CVNA) has long been a disruptor in the automotive retail space, pioneering an e‐commerce platform for buying and selling used cars. Headquartered in Phoenix, Arizona, the company is renowned for its innovative approach—including its signature car vending machines—and its fully integrated, digital-first business model that encompasses everything from vehicle sourcing and reconditioning to financing and delivery. The company provides an end-to-end digital car purchasing process, allowing consumers to browse, finance, trade-in, and have vehicles delivered directly to their homes—all without the need for a physical dealership.

Founded in 2012, Carvana's business strategy hinges on cutting out traditional dealership middlemen, enabling the company to operate with lower overhead costs while providing competitive pricing and a vast inventory. A key component of its model is its network of car vending machines, which serve as highly automated pick-up points for customers who prefer an in-person experience. Additionally, Carvana’s acquisition of ADESA’s U.S. physical auction business has strengthened its wholesale capabilities, further enhancing its supply chain efficiency and overall market reach. In its recent third‐quarter announcement, Carvana reported a net income of $148 million and achieved a record adjusted EBITDA of $429 million, buoyed by a robust 34% year-over-year growth in retail units sold.

The impressive financials are a testament to the strength of its vertically integrated model, which has enabled the company not only to reduce costs but also to enhance customer experience. Looking ahead to the fourth quarter, management expects further sequential improvement in year-over-year retail unit growth and has raised full-year EBITDA guidance, signaling that Carvana’s turnaround is well underway. Currently trading at around $247, Carvana’s stock has rebounded strongly in 2024 after undergoing significant layoffs, debt restructuring, and operational improvements. The company’s turnaround strategy appears to be bearing fruit, as evidenced by record quarterly results and renewed investor confidence.

Analysts remain divided on the near-term outlook—with some cautioning about potential risks in auto lending and regulatory scrutiny. In contrast, others remain bullish on the company’s prospects for continued expansion and margin improvement. Over the last year, CVNA achieved a 487% annual yield, with its stock rising from $42.16 to $247.48. This growth highlights the effectiveness of our analytical tools in identifying high-potential stocks.

Our system unveiled a Top 5 stock picks list on January 25th, 2024, focusing on stocks with high return potential. In today's complex financial markets, data-driven strategies are crucial for maximizing returns and minimizing risks.

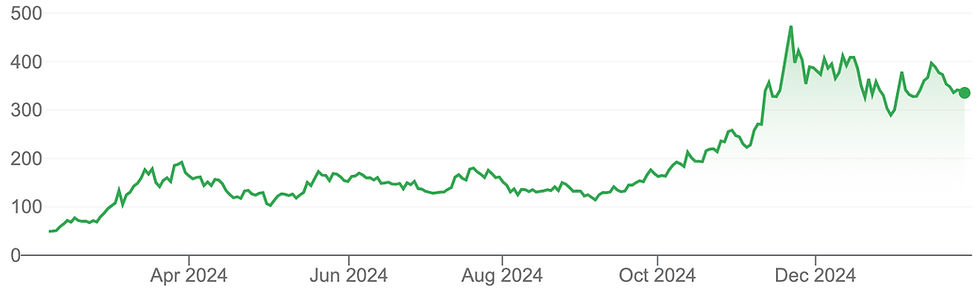

The Top 5 Performance Visualized

Top 5 Average ROI: 306.62%

Hit Ratio: 100%

S&P 500 Performance: 21.90%

AI-Forecast Market Outperformance: 284.72%

Time Horizon: 365 Days (12-Months)

Forecast Period: January 31st, 2024, to January 30th, 2025

Alphabet Inc Class C (NASDAQ: GOOG): 42.74%

Carvana Co (NYSE: CVNA): 487%

Stifel Financial Corp (NYSE: SF): 56.32%

Robinhood Markets Inc (NASDAQ: HOOD): 380.13%

MicroStrategy Inc (NASDAQ: MSTR): 566.91%

Recent Financial Performance and Growth Trajectory

Carvana’s financial results for the third quarter of 2024 underscore the strength of its business model and its accelerating growth trajectory. The company reported a net income of $148 million, a significant milestone reflecting improved operational efficiency and higher margin sales. Furthermore, Carvana achieved an adjusted EBITDA of $429 million, representing an industry-leading margin of 11.7%, which is unparalleled among public automotive retailers.

The company's Q3 performance was driven by a robust 34% year-over-year growth in retail units sold, with total revenue reaching $3.655 billion, an increase of 32% from the previous year. This level of expansion highlights the effectiveness of Carvana’s vertically integrated approach, which includes proprietary vehicle reconditioning centers, strategic logistics infrastructure, and advanced digital marketing strategies.

Carvana's ability to generate sustainable profitability is further demonstrated by its net income margin of 4.0%, an impressive feat considering the capital-intensive nature of the automotive retail sector. The company also posted a record GAAP operating income of $337 million, reinforcing its capacity to scale profitably in an increasingly competitive landscape.

Alongside its solid financial performance, Carvana has been accelerating its strategic initiatives. The company continues to expand its same-day delivery service into new markets such as Houston, Las Vegas, and Atlanta, further broadening its national footprint. Recent press releases have highlighted an investor tour at its Haines City, Florida inspection and reconditioning center, underscoring its commitment to operational excellence and transparency. In tandem with these expansions, Carvana has secured a significant agreement with Ally Financial to sell up to $4 billion in automotive finance receivables—a move designed to bolster liquidity and support future growth initiatives

The stock’s performance has not gone unnoticed on Wall Street. JPMorgan recently raised its price target to $350, citing the company’s strong unit economics and resilient profit margins, while other research firms continue to assign Carvana a “Moderate Buy” rating. Analyst consensus appears mixed but optimistic, with various price targets averaging between $244 and $253. Despite some short-term volatility—including a temporary drop in share price following the release of a critical short-seller report—investors remain focused on Carvana’s long-term turnaround story.

Outlook and Future Growth Prospects

Looking ahead to the fourth quarter and beyond, Carvana has provided a bullish outlook, expecting a continued sequential increase in its year-over-year retail unit growth rate. The company also anticipates adjusted EBITDA to surpass the upper end of its previously forecasted range of $1.0 to $1.2 billion for the full year 2024. If current market conditions remain stable, Carvana’s path toward further profitability and expansion remains highly favorable.

Notwithstanding these positive developments, Carvana has not been without controversy. A high-profile report by Hindenburg Research recently accused the company of engaging in questionable accounting practices and lax underwriting, alleging that nearly $800 million in loan sales were made to an undisclosed related party. These allegations, which also pointed to potential insider trading and manipulation of reported income, led to a brief but notable decline in the stock. However, several analysts from firms such as JPMorgan have dismissed the concerns as “overblown,” emphasizing that Carvana’s EBITDA per unit and free cash flow metrics remain in line with industry peers.

Further complicating the landscape, Carvana is addressing regulatory and customer service challenges. In Connecticut, for example, the company has agreed to a $1.5 million settlement to resolve complaints related to delayed title and registration processes, as well as allegations of misleading vehicle descriptions. This settlement, which is designed to reimburse affected consumers and improve compliance, illustrates the growing pains associated with rapid expansion during and after the COVID-19 pandemic

A broader perspective on Carvana’s evolution can be gleaned from comparisons with industry peers. While companies like Hertz have struggled under debt pressures and operational missteps—sometimes even flirting with bankruptcy—Carvana’s disciplined restructuring, aggressive cost-cutting, and focused investment in technology and logistics have allowed it to not only recover from a dramatic stock price collapse (from a low of $3.72 in December 2022) but also to post a multi-thousand-percent return over the past two years. This contrast underscores the importance of choosing the right strategic path in a volatile market

.

Conclusion

Carvana stands at a critical juncture, poised between opportunity and challenge. The company has demonstrated a remarkable ability to rapidly scale its operations, which is evident in its expanding footprint across the United States, as well as its innovative approach to the used-car market. Through strategic investments in technology and infrastructure, Carvana has not only improved its financial performance but has also redefined the customer experience in vehicle purchasing. This transformation includes features such as online vehicle selection, home delivery, and a streamlined financing process, which collectively enhance consumer convenience and satisfaction.

However, the path forward is not without its hurdles. Recent controversies, including the Hindenburg report— which raised serious concerns about the company's business practices and financial disclosures—along with recent consumer settlements, introduce an element of risk that cannot be overlooked. These issues have the potential to impact investor confidence and public perception. Nevertheless, despite these challenges, the underlying fundamentals of the business remain strong. Carvana has reported significant growth in retail unit sales, which indicates a rising demand for its services. Furthermore, the company has improved its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margins, showcasing its ability to manage costs effectively while driving revenue growth.

In addition to these financial metrics, Carvana has been proactive in forming strategic partnerships that bolster its market position. Collaborations with financial institutions and technology providers have enhanced its operational capabilities and broadened its reach within the competitive landscape of the U.S. used-car market. These alliances not only provide additional resources but also facilitate access to new customer segments, further solidifying Carvana's standing as a leader in the industry.

As the company continues to navigate a complex environment filled with regulatory challenges and competitive pressures, its future success will hinge on several critical factors. One of the foremost challenges will be its ability to sustain profitability while enhancing transparency in its operations. This is particularly important in light of the scrutiny it faces from regulators and the public. Improving operational efficiency will also be essential, as it can lead to reduced costs and improved service delivery, ultimately benefiting customers and shareholders alike. Investors will be watching closely as Carvana executes its ambitious plans for 2025 and beyond. The company’s strategic roadmap includes not only expanding its market share but also enhancing its technological capabilities and customer service offerings. By focusing on these areas, Carvana aims to solidify its position as a dominant player in the used-car market, ensuring long-term growth and stability. The coming years will be pivotal, as the company strives to balance growth ambitions with the need for operational integrity and consumer trust, which are crucial for sustaining its competitive edge in an ever-evolving marketplace.

Enhanced Market Intelligence

Finding market opportunities is made easier by using our AI system. It doesn't tell you what to do. It tells you where to look. Our skilled team of analysts carefully verifies the AI outputs and enhances this market research with a human touch, providing our subscribers with enhanced market intelligence. If you would like the AI advantage working for you, then you should subscribe today!

Life is better when you can be bullish.

Sources: 1. Carvana Investor Relations, "Carvana Announces Industry-Leading Third Quarter 2024 Results" (2024)

Comments