Evercore (EVR) showcases remarkable growth with a 70.46% stock price surge, validating predictive analytics and reinforcing its position as a leading independent advisory firm amid strong Q2 2024 results.

Evercore Inc. (NYSE: EVR), founded in 1995, stands as a premier global independent investment banking advisory firm. Headquartered in the heart of New York City, Evercore has established itself as a formidable player in the financial services industry, offering a wide array of services to a diverse clientele that includes multinational corporations, institutional investors, governments, and high-net-worth individuals.

The company's core business revolves around providing strategic and financial advice to clients navigating complex transactions and business challenges. Evercore's primary service offerings include mergers and acquisitions (M&A) advisory, restructuring and debt advisory, capital markets advisory, and institutional equities. What sets Evercore apart from traditional bulge bracket banks is its steadfast commitment to remaining independent, allowing it to provide unbiased advice free from the conflicts of interest that can arise when firms engage in proprietary trading or underwriting. Evercore's global footprint extends far beyond its New York base, with offices strategically located in major financial hubs across North America, Europe, and Asia. This international presence enables the firm to serve clients seamlessly across borders and tap into local market expertise. Notable locations include London, Hong Kong, Toronto, and São Paulo, among others.

The company's client base is as diverse as it is prestigious. Evercore caters to Fortune 500 companies, middle-market firms, private equity houses, and sovereign wealth funds. Its sector expertise spans a broad spectrum, including technology, healthcare, industrials, consumer goods, energy, and financial services. This wide-ranging industry knowledge allows Evercore to provide nuanced, sector-specific advice that considers each market's unique dynamics. Evercore's business model is primarily fee-based, deriving the bulk of its revenues from advisory services. This approach aligns the firm's interests closely with those of its clients, as success is measured by the outcomes achieved rather than the volume of transactions processed. This client-centric focus has helped Evercore build long-standing relationships and a track record of repeat business.

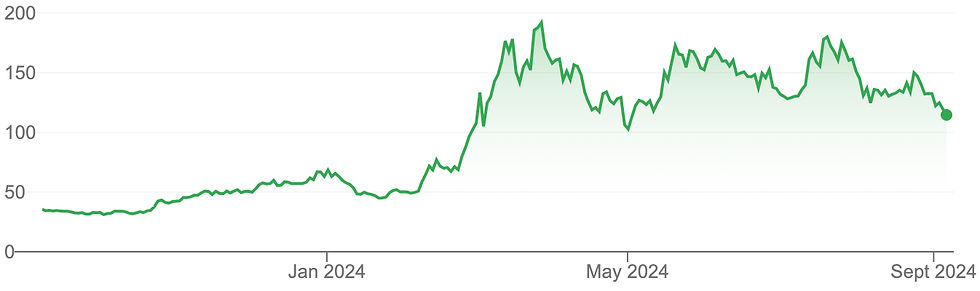

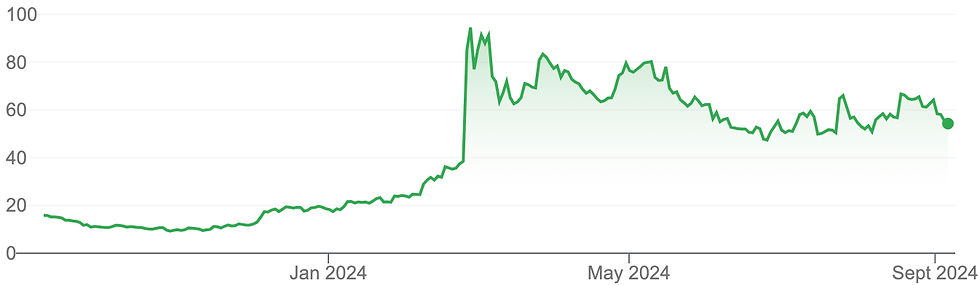

EVR stock has demonstrated notable performance in the market over the past year, transitioning from a relatively unknown entity to a significant investment opportunity. Our predictive analytics platform identified EVR as a promising growth prospect one year ago when it was trading at $137.33. This projection has been validated, with EVR's stock price increasing to $234.09, representing a 70.46% appreciation.

This performance underscores the potential value of data-driven market analysis. For context, the complete top 5 stock forecast from one year ago, which includes the EVR prediction, is provided below.

The Top 5 Performance Visualized

Top 5 Average ROI: 152.95%

Hit Ratio: 100%

S&P 500 Performance: 21.95%

AI-Forecast Market Outperformance: 131%

Time Horizon: 365 Days (12-Months)

Forecast Period: September 7th, 2023, to September 6th, 2024

1. MicroStrategy Inc (NASDAQ: MSTR): 229.87%

2. Abercrombie & Fitch Co (NYSE: AN): 135.82%

3. Evercore Inc (NYSE: EVR): 70.46%

4. Boot Barn Holdings Inc (NYSE: BOOT): 54.52%

5. Viking Therapeutics Inc (NASDAQ: VKTX): 274.08%

Robust Growth in Q2 2024

Evercore Inc. (NYSE: EVR), the premier global independent investment banking advisory firm, has reported its second quarter 2024 results, showcasing impressive growth and resilience in a gradually recovering market. The firm's performance underscores its strategic positioning and ability to capitalize on emerging opportunities in the financial advisory landscape.

Financial Highlights:

Evercore's second-quarter results paint a picture of substantial year-over-year growth. Net revenues on a U.S. GAAP basis reached $689.2 million, marking a 38% increase from the same period in 2023. On an adjusted basis, net revenues climbed to $695.3 million, representing a similar 38% year-over-year growth. These figures not only indicate a strong quarter but also set a new record for second-quarter performance in the company's history.

The firm's advisory fees, a crucial metric for its core business, surged by 52% year-over-year to $568.2 million on a U.S. GAAP basis. This significant uptick reflects an increase in both the number of advisory fees earned and revenue from large transactions, highlighting Evercore's ability to secure and execute high-profile mandates.

Profitability also saw substantial improvements. Operating income on a U.S. GAAP basis jumped by 88% to $108.2 million, while adjusted operating income rose by 80% to $114.3 million. The operating margin expanded impressively, increasing by 415 basis points to 15.7% on a U.S. GAAP basis and by 388 basis points to 16.4% on an adjusted basis.

Market Position and Deal Flow:

Evercore's market position remains strong, as evidenced by its involvement in three of the six largest global transactions year-to-date. Notable deals include advising General Electric on its spin-off of GE Vernova for approximately $36 billion, Synopsys on its $35 billion acquisition of Ansys, and ConocoPhillips on its $22.5 billion acquisition of Marathon Oil. These high-profile transactions underscore Evercore's ability to navigate complex, large-scale deals across various sectors.

The firm's expertise has not gone unnoticed in the industry. Evercore clinched two awards from The Banker's 2024 Investment Banking Awards, including "Investment Bank of the Year for M&A" and "Investment Bank of the Year for Private Placements." Furthermore, the firm was recognized as the "Deal of the Year for M&A" for its role in Nippon Steel's pending $15 billion acquisition of U.S. Steel.

Talent Acquisition and Expansion:

Evercore continues to bolster its team with strategic hires. In the second quarter, the firm welcomed Jeffrey Haller as a Senior Managing Director in the Financial Institutions Group. Looking ahead, three additional Investment Banking Senior Managing Directors and one Senior Advisor have committed to join the firm, further expanding its capabilities in Paris and strengthening its banking sector expertise in the U.S.

Capital Management and Shareholder Returns:

The firm maintains a strong focus on returning capital to shareholders. In the first six months of 2024, Evercore returned $395.6 million to shareholders through dividends and share repurchases. The company repurchased 1.8 million shares at an average price of $178.61. Additionally, the Board of Directors declared a quarterly dividend of $0.80 per share, demonstrating confidence in the firm's financial position and commitment to shareholder value.

Market Outlook and Strategic Positioning:

Chairman and CEO John S. Weinberg expressed optimism about the gradual market recovery, noting increased momentum across many of Evercore's businesses. The firm's expanded product range and diverse client base position it well to capitalize on emerging opportunities in the evolving financial landscape.

Founder and Senior Chairman Roger C. Altman highlighted the consistent expansion in the number of Senior Managing Directors as a key driver of the firm's record-breaking quarter. This growth in talent underscores Evercore's ability to attract top professionals and expand its capabilities.

Challenges and Considerations:

Despite the strong performance, Evercore faces ongoing challenges. The cyclical nature of the M&A market exposes the firm to potential fluctuations in deal activity. Additionally, the company operates in a highly competitive environment, contending with both independent advisory firms and full-service investment banks.

The firm's compensation ratio, while improving year-over-year, remains a focus area. At 66.6% for the second quarter on a U.S. GAAP basis (66.0% adjusted), it reflects the competitive nature of talent acquisition and retention in the industry.

Conclusion:

Evercore's second-quarter 2024 results highlight the firm's resilience and capacity to excel in a recovering market environment. The company has demonstrated substantial revenue growth, particularly in advisory fees, alongside improved profitability metrics, positioning it favorably within its peer group. This strong performance is further evidenced by EVR stock's remarkable trajectory over the past year. Our predictive analytics platform identified EVR as a promising growth prospect when it was trading at $137.33, and this projection has been validated spectacularly, with the stock price surging to $234.09 – a substantial 70.46% gain.

Evercore's involvement in significant global transactions and industry accolades, coupled with this impressive stock performance, solidify its standing as a premier independent advisory firm. The stock's transition from a relatively unknown entity to a significant investment opportunity underscores both the company's growth and the potential value of data-driven market analysis.

Moving forward, Evercore's strategic talent acquisition initiatives and expanded service offerings are expected to enable the firm to capitalize on the gradual market recovery. However, the company must adeptly navigate challenges inherent to market cyclicality and intense sector competition. Supported by a robust balance sheet, strong capital return program, and clear strategic direction, Evercore appears well-positioned to sustain its growth trajectory and maintain its competitive advantage in the global financial advisory landscape.

This remarkable stock performance, combined with strong fundamentals and strategic positioning, suggests that Evercore is not only weathering market challenges but is poised for continued success in the evolving financial advisory sector.

Enhanced Market Intelligence

Finding market opportunities is made easier by using our AI system. It doesn't tell you what to do. It tells you where to look. Our skilled team of analysts carefully verifies the AI outputs and enhances this market research with a human touch, providing our subscribers with enhanced market intelligence. If you would like the AI advantage working for you, then you should subscribe today!

Life is better when you can be bullish.

Sources: 1. Evercore Inc. Investor Relations, "EVERCORE REPORTS SECOND QUARTER 2024 RESULTS;QUARTERLY DIVIDEND OF $0.80 PER SHARE" (2024)

Comments