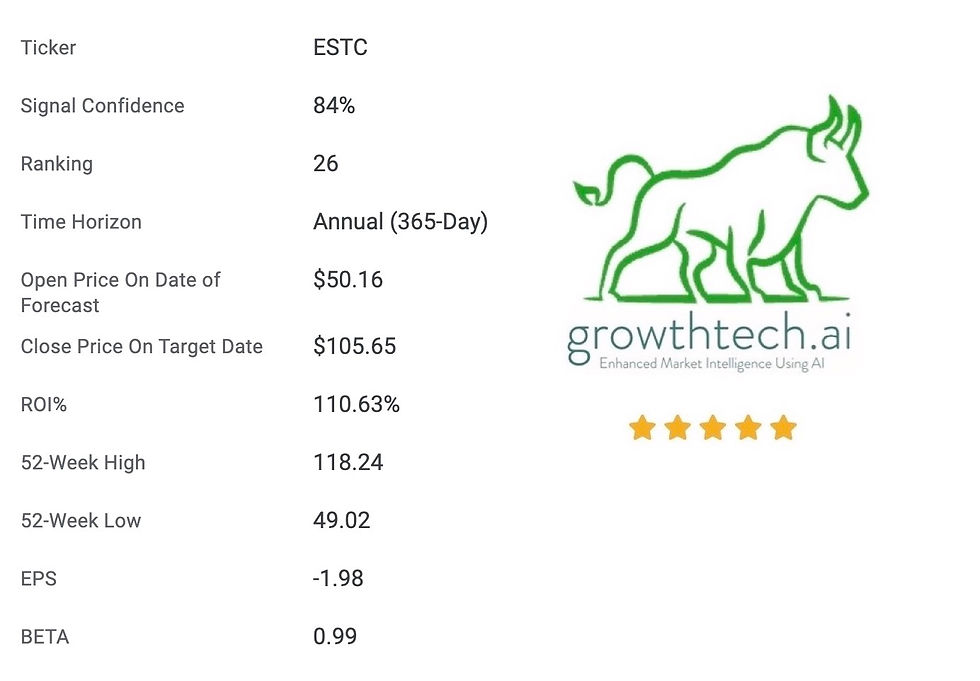

Starting the year off right, the opening price on the date of the forecast was $50.16 on January 3rd, 2023, and closed at $105.65 on January 3rd, 2024 making 110.63% profit for subscribers. At the time of writing the stock is now trading north of $111.

Elastic NV, previously known as Elasticsearch, is an American-Dutch company founded in 2012. The company is headquartered in Amsterdam, the Netherlands, and Mountain View, California, USA. It is a search company that builds self-managed and software-as-a-service (SaaS) offerings for search, logging, security, observability, and analytics use cases. The company develops the Elastic Stack— Elasticsearch, Kibana, Beats, and Logstash—previously known as the ELK Stack.

Elastic NV’s primary product, Elastic Stack, is a set of software products that ingest and store data from various sources and formats, as well as perform search, analysis, and visualization on that data. The company’s product portfolio consists of Enterprise Search, Observability, Security, Elastic Stack, SaaS, and Orchestration. Elastic NV markets its solutions to various industries including automotive, education, financial services, government, defense, e-commerce, and technology. It partners with cloud providers, systems integrators, channel partners, referral partners, OEM, and MSP partners. The company operates its business across the Americas, Europe, and Asia.

Despite its impressive stock performance, Elastic NV has faced several challenges. The company’s operating margin is currently at -11.67%, which, while not ideal, is better than 30.3% of 2756 companies in the same sector. Elastic’s return on equity (ROE) stands at -47.15%, surpassing 15.83% of its peers. In addition, Elastic NV announced a 13% reduction in headcount on November 30, 2022. This decision was cited as a response to headwinds from the global macroeconomic environment. Furthermore, the company has experienced a management shakeup, with Founder and CEO Shay Banon stepping down from the CEO role and being replaced by Ashutosh Kulkarni. These changes have caused some uncertainty and volatility in the company’s stock performance

Elastic NV (ESTC) Q2 Fiscal 2024: A Comprehensive Evaluation

Elastic NV, the innovative force behind Elasticsearch, unveiled robust financial results for its second quarter of fiscal 2024 ended October 31, 2023. The reported total revenue of $311 million marked an impressive 17% YoY surge, demonstrating sustained growth momentum. Of particular note was Elastic Cloud revenue, soaring to $135 million, reflecting a remarkable 31% YoY uptick, accentuating the company's prowess in cloud-based solutions.

However, a nuanced analysis reveals deeper insights. The constant currency basis, considering exchange rate fluctuations, illustrated a 16% increase YoY. This adjustment is crucial for a comprehensive understanding of Elastic NV's underlying operational performance, especially in the context of global economic dynamics.

Financial Metrics and Operational Efficiency:

The financial metrics present a mixed picture. The GAAP operating loss of $22 million with a margin of -7% reflects the inherent challenges in balancing innovation and profitability. Conversely, the Non-GAAP operating income of $41 million with a margin of 13% is indicative of the company's success in optimizing operational efficiency.

The discrepancy between GAAP and Non-GAAP metrics underscores Elastic NV's strategic focus on investments in artificial intelligence (AI). CEO Ash Kulkarni emphasized the company's commitment to generative AI, attributing the Q2 success to the innovation in AI. The positive trajectory in Non-GAAP metrics suggests that these investments are yielding returns, fostering customer excitement and engagement.

Key Customer Metrics:

Elastic NV's customer metrics reveal a resilient and expanding clientele. The total subscription customer count surpassing 20,700 in Q2 FY24, compared to approximately 20,500 in the previous quarter, signifies a steady growth trajectory. Particularly noteworthy is the expansion of the customer count with Annual Contract Value (ACV) exceeding $100,000, surpassing 1,220 in Q2 FY24. This customer segmentation underscores Elastic NV's ability to attract and retain high-value clients, a pivotal factor for sustained revenue growth.

The Net Expansion Rate of approximately 110% further accentuates customer loyalty and the incremental value derived from existing clients. Elastic NV's success in maintaining and expanding its customer base is pivotal for future revenue streams and solidifies its position in the competitive landscape.

Product Innovations and Updates:

Elastic NV's commitment to technological innovation is evident in the array of product updates and introductions. The launch of Elastic Learned Sparse EncodeR (ELSER) and Elasticsearch Query Language (ES|QL) reflects the company's dedication to semantic and piped query capabilities, catering to diverse user needs. Universal Profiling's integration into Elastic Observability enhances the platform's versatility, eliminating the need for code instrumentation and other cumbersome processes.

The collaboration with LangChain and updates to vector database capabilities illustrate Elastic NV's proactive approach to staying at the forefront of generative AI and data analytics. These innovations not only attract new customers but also enhance the value proposition for existing ones, contributing to the impressive Net Expansion Rate.

Strategic Collaborations and Business Highlights:

Elastic NV's strategic moves, such as the acquisition of Opster and the collaboration with AWS, bolster its position in the market. The Opster acquisition, focused on monitoring, managing, and troubleshooting Elasticsearch and OpenSearch, aligns with Elastic NV's commitment to providing comprehensive solutions to its clientele.

The Strategic Collaboration Agreement (SCA) with AWS signifies Elastic NV's strategic positioning in the cloud computing domain. This collaboration, particularly with Amazon Bedrock, aligns with the industry trend of leveraging AI assistants, emphasizing Elastic NV's commitment to staying ahead in the rapidly evolving tech landscape.

Financial Outlook and Conclusions:

Elastic NV's financial outlook for Q3 FY24 and the full fiscal year 2024 instills confidence in its continued growth trajectory. With an expected total revenue between $319 million and $321 million for Q3 FY24 and a projected total revenue between $1.247 billion and $1.253 billion for fiscal 2024, Elastic NV anticipates a 17% YoY growth at the midpoint, emphasizing sustained momentum.

The Non-GAAP operating margin guidance between 11.5% and 12.0% for Q3 FY24 and 10.25% to 10.75% for fiscal 2024 reflects a balanced approach between growth investments and operational efficiency. The projected Non-GAAP earnings per share, ranging from $0.30 to $0.32 for Q3 FY24 and $1.06 to $1.15 for fiscal 2024, demonstrate Elastic NV's commitment to delivering shareholder value.

In conclusion, Elastic NV's Q2 Fiscal 2024 results and forward-looking guidance portray a company strategically positioned for sustained growth. The confluence of financial strength, technological innovation, and strategic collaborations positions Elastic NV as a formidable player in the data management and analytics sector. Investors and stakeholders are well-advised to monitor Elastic NV's trajectory, considering its financial resilience and commitment to technological leadership in an era defined by data-driven excellence.

Enhanced Market Intelligence

Finding market opportunities is made easier by using our AI system. It doesn't tell you what to do. It tells you where to look. Our skilled team of analysts carefully verifies the AI outputs and enhances this market research with a human touch, providing our subscribers with enhanced market intelligence. If you would like the AI advantage working for you, then you should subscribe today!

Life is better when you can be bullish.

Sources: 1. Elastic NV's Investor Relations, "Elastic Reports Second Quarter Fiscal 2024 Financial Results" (2023)

Comments